Property rights and GDP growth are positively linked

Ottobre 2013 / Innovazione e mercato

Scritto da Francesco Di Lorenzo e Pietro Paganini

PDF

PDF

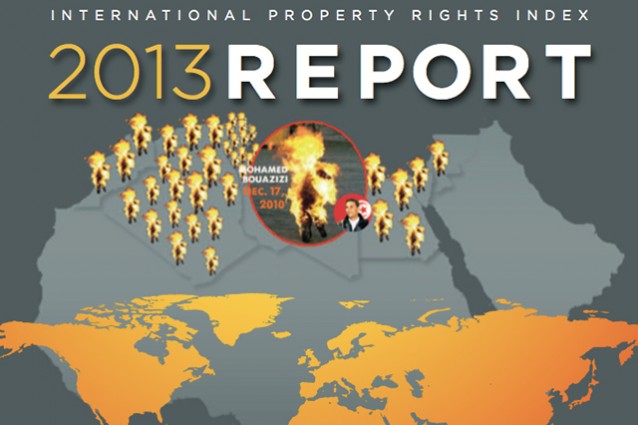

The 2013 International Property Rights Index (IPRI), recently published by the Property Rights Alliance (and in Italy by Competere- Policies for Sustainable Development) measures the efficiency of property right protection in 131 countries, accounting for more than 98% of global GDP and 93% of the worldwide population. Among the most fascinating insights illuminated in the Index, which is based on data from the World Bank, OCSE and the World Economic Forum, arethe results about the relationship between property right protection and GDP growth. In particular, the study clearly shows that there is a positive relationship between the two: a high level of development of a given regime of property right protection is associated to a high national economy performance. This result appears to be particularly important if one considers that regulatory regimes regarding property rights are not necessarily prioritized as strategic tools when promoting the GDP growth main drivers.

But, what does it take for a property rights regime to be developed? The definition proposed in the study is comprised of three primary components. The first indicator concerns the Legal and Political Environment of the 131 countries (political stability, corruption, independence of the judiciary, rule of law). The second and the third components measure the effectiveness of the regulatory framework for the protection of Physical Property Rights and of the Intellectual Property Rights.

At the top of the Index one finds the “usual suspects”: the Scandinavian countries (Finland is the first with an overall score of 8.6, followed by Sweden with 8.4), the Netherlands and Switzerland. The G7 countries are all ranked within the first 20 positions (the UK is 12th with 7.8, Germany 14th with 7.7, the US 17th with 7.6 and France 20th with 7.3), except for Italy, which is ranked 47th. Italy’s poor ranking is mainly explainedby the poor performance of the Legal and Political Environmentcomponent. The Italy low score is mainly explained but the decreased score of the judicial independence of the Italian system from the most influential economic and political interests groups in the country, and by the increased difficulty to access credit for initiating new entrepreneurial activities. Indeed, it appears that entire industrial production sectors in Italy are under attack from international counterfeiting schemes.

Another interesting finding of the Index is the impact of gender (in)equality in the 84 countries in which gender influences property rights. The gender component measures: female access to land, access to credit, to property other than land, women’s social rights and the inheritance practices of each county. Singapore tops the ranks with a score of 9.9 and is followed by Hong Kong with a score of 9.7. The remaining countries in the top 10 are more geographically dispersed includingnations from the Middle East, Africa, and Latin America. Burundi has the lowest score at 4.1.

Is this a useful tool for policy makers? Yes indeed. Beside an educational instrument that links property rights, growth and innovation, it shall serve to produce those reforms and regulation that help any world region to become more competitive.

INDICE Ottobre 2013

Editoriale

Monografica

- E' (ancora) il tempo dell'ottimismo razionale

- Oltre la gerontocrazia sessantottina

- Come sopravvivere ai tempi del credit crunch

- Il trionfo della speranza sull'esperienza

- Benedetta questa crisi (se ci salverà dalla paralisi)

- La Casta non basta: il vero spreco sono vent'anni di non riforme

- La spesa pubblica è finita, andate in pace

Istituzioni ed economia

- Ma la ripresa è ancora un miraggio

- Cronache da Nottingham – In Italia si legifera solo per eccezioni

- Mal di banca. Come e perché nulla sarà più come prima

- Renzi e la sindrome del braccio destro usa e getta

- Il crepuscolo dei liberali tedeschi. Intervista a Frank Schäffler

- Pagheremo le accise, ma non prendeteci in giro

Innovazione e mercato

- Quell'assurda mazzata sulle sigarette elettroniche

- Sulla Route 66 della mozzarella di bufala

- L'equivoco, molto italiano, dei minijob tedeschi

- Property rights and GDP growth are positively linked

Scienza e razionalità

- Il futuro delle biotech italiane, una promessa da mantenere

- La lezione di Stamina e quel che abbiamo rischiato davvero

- Il congedo della ricerca

Diritto e libertà

- Parità per gli uomini. Dentro il tabù della questione maschile

- Soccorso e pregiudizio

- Claudio Martelli: "Abolire reato di clandestinità e pattugliare coste africane"

Terza pagina